When is the Next Crypto Bull Run? If you’re someone who’s been eagerly waiting for the next surge in the cryptocurrency market, you’re not alone. The crypto bull run, characterized by a significant increase in cryptocurrency prices, is a highly anticipated event for many investors and enthusiasts alike. But the million-dollar question remains:

When Will It Happen?

Predicting when the next crypto bull run will happen is difficult due to the volatility of the cryptocurrency market. However, by studying past trends, market signs, and the general outlook on cryptocurrency, we can get an idea of when the next bull run could take place.

It’s important to remember that any predictions about when a crypto bull run will occur should be taken with a pinch of salt. The crypto market is incredibly unpredictable, and a range of elements can shape its direction. Let’s investigate the components that can influence when a bull run might take place. Are you ready to explore this topic? Let’s get started!

It’s impossible to predict exactly when the next cryptocurrency bull run will occur, as it’s dependent on a variety of factors including market trends, adoption rates, and regulatory changes. To stay informed, keep tabs on the market, read up on reliable crypto news, and participate in crypto-related online communities. Keep in mind that investing in this space comes with risks, so make sure to conduct extensive research and get professional advice before making any decisions. Remain patient, and be ready to take advantage of any potential opportunities when the market is in your favor.

When is the Next Crypto Bull Run?

Cryptocurrency investors are always eagerly anticipating the next bull run – a period of notable price rises in the market. However, predicting when the next bull run will occur is tricky. Some analysts make ambitious forecasts while others advise against predicting. In this article, we will delve into the elements that could determine when the next crypto bull run will take place and the techniques investors can use to cope with the unpredictability.

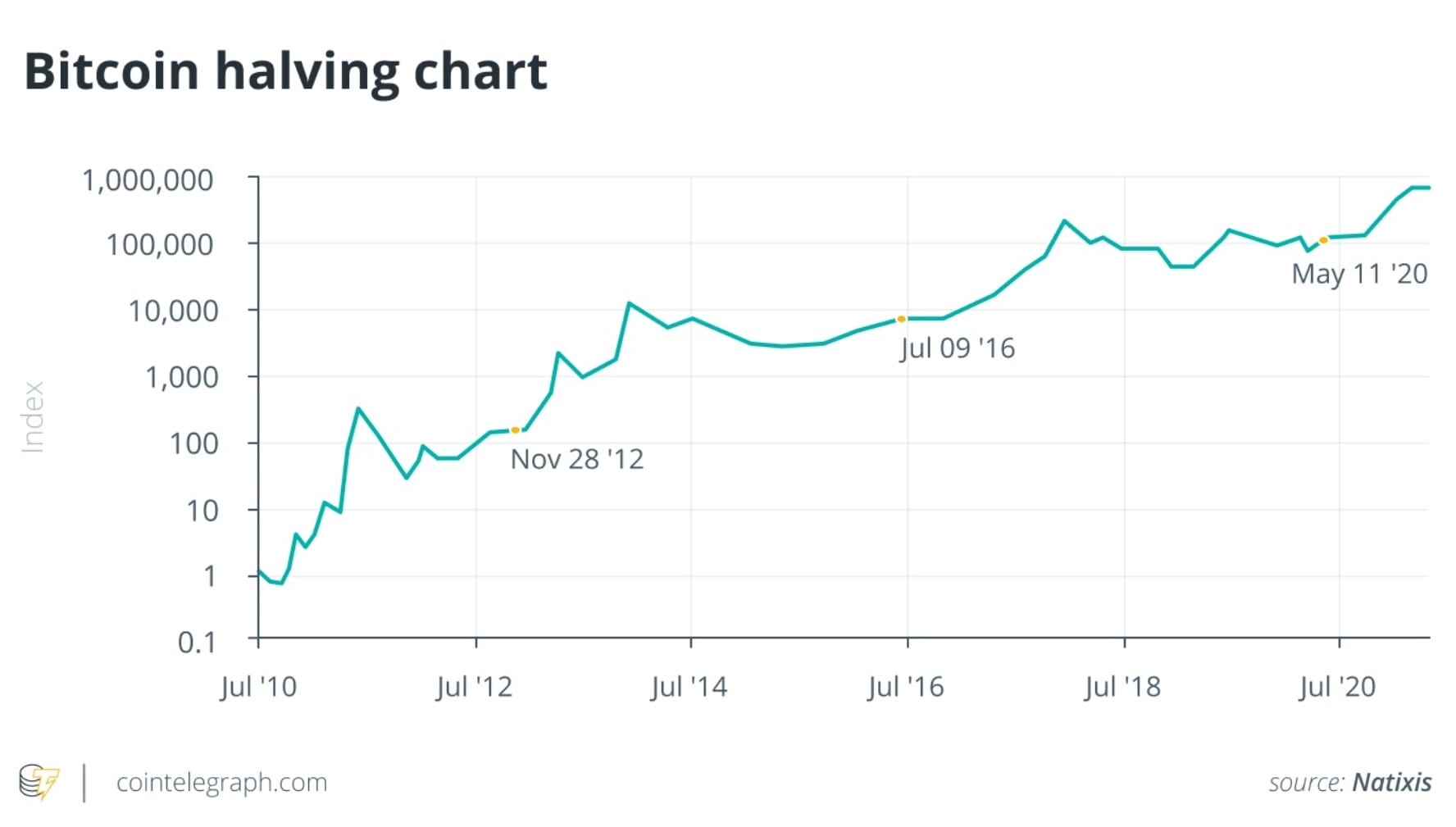

Understanding Market Cycles

One important concept to grasp when trying to predict the next crypto bull run is the idea of market cycles. Cryptocurrencies, like any other investment, go through cycles of boom and bust. During a bull run, prices skyrocket as demand outpaces supply, resulting in significant gains for investors. However, these bullish periods are often followed by bear markets, where prices plummet and investor sentiment turns negative.

Market cycles are influenced by a range of factors, including market liquidity, investor sentiment, regulatory developments, technological advancements, and macroeconomic trends. By studying historical patterns, investors can gain insights into how these factors interact and potentially identify the signs that precede a bull run. However, it’s important to note that past performance is not a guarantee of future results, and market conditions can change quickly.

When it comes to the next crypto bull run, analysts and experts have varying opinions. Some believe that the market is overdue for a bull run, citing factors such as increased institutional involvement, growing mainstream acceptance, and the maturing infrastructure of the cryptocurrency ecosystem. Conversely, others argue that the crypto market is still highly speculative and volatile and that a bull run may be further down the road.

Factors Affecting the Timing of the Next Bull Run

It is unclear when the next crypto bull run will happen, but there are certain components that can affect its timing. Here are some important points for investors to keep in mind:

1. Economic and Political Conditions

The global economic and political landscape can have a significant impact on the cryptocurrency market. Economic downturns or political instability can lead investors to seek alternative investments, potentially driving up demand for cryptocurrencies. On the other hand, positive economic conditions and regulatory clarity can provide a favorable environment for the crypto market to thrive.

2. Regulatory Developments

As governments globally try to define their stance on cryptocurrencies, the regulatory landscape continues to take shape. Positive regulation that provides clarity and safeguards for investors can increase the confidence in cryptocurrencies, potentially setting off a bull market. Conversely, overly restrictive regulations or negative regulatory news can weaken market sentiment and delay the onset of a bull market.

3. Technological Advancements

Technological advancements within the cryptocurrency ecosystem, such as scalability solutions or improved security protocols, can play a role in driving market sentiment. Breakthroughs in blockchain technology or the development of user-friendly applications can attract new investors and fuel demand for cryptocurrencies, potentially leading to a bull run.

4. Market Sentiment and Investor Psychology

Investor sentiment and psychology play a crucial role in driving cryptocurrency prices. During a bull run, positive sentiment can create a self-perpetuating cycle of buying as investors fear missing out on potential gains. Conversely, during bear markets, fear and panic selling can exacerbate price declines. Keeping a pulse on investor sentiment through social media, news, and market indicators can provide valuable insights into market trends.

Strategies for Navigating the Crypto Market

While predicting the timing of the next bull run may be challenging, there are strategies that investors can employ to navigate the crypto market in any market cycle:

1. Diversify Your Portfolio

Diversifying investments across different cryptocurrencies can help reduce risk and increase the chances of gaining returns, regardless of the market situation. This strategy mitigates reliance on a single cryptocurrency and spreads the risk among several assets with different growth prospects.

2. Stay Informed

Keeping up-to-date with the latest news, market trends, and regulatory developments is essential for crypto investors. By staying informed, investors can make more informed decisions and react to market changes quickly. Social media platforms and cryptocurrency news websites can be valuable sources of information.

3. Set Realistic Expectations

It is easy to get swept up in the potential of large returns during a cryptocurrency bull run, however, it is important to remain realistic and not succumb to the hype. Investing in digital assets entails risks and it is essential to be aware of the volatility of the crypto realm. Establishing realistic objectives and having a long-term outlook can assist in navigating the highs and lows of the crypto market.

The Importance of Patience and Perspective

Patience is essential when anticipating the timing of the subsequent crypto bull run. The cryptocurrency market is still quite young and constantly changing, so it is typical for it to experience cycles of highs and lows. Rather than concentrate on short-term price changes, investors should pay attention to the long-term potential of cryptocurrencies and the technology behind them.

The exact moment of the upcoming bull run may be unknown, but it’s certain that cryptocurrencies are here to stay. As digital and decentralized solutions become more prevalent, cryptocurrencies provide a distinctive and revolutionary approach to storing and transferring value. To make the most of the potential of the crypto market, investors should stay up-to-date, diversify their portfolios, and think long-term.

Key Takeaways: When is the Next Crypto Bull Run?

- The timing of the next crypto bull run is uncertain and difficult to predict.

- Many experts believe that a bull run could happen in the near future due to various factors such as increased institutional adoption and regulatory clarity.

- Crypto bull runs are often driven by market sentiment and investor speculation.

- Prior to investing in the crypto market, it is essential to carry out comprehensive research and evaluation.

- Diversification and having a long-term investment strategy are crucial for navigating the volatile nature of cryptocurrencies.

Moreover, it is essential to understand that cryptocurrency prices can be volatile, and the market can go up and down unexpectedly. It’s crucial to set realistic expectations and not get caught up in the hype. Remember to invest only what you can afford to lose and seek advice from professionals if needed.

The Intersection of Political Campaigns and Crypto