Tax management software simplifies tax calculations and ensures compliance with regulations, reducing the risk of errors. It automates tax filing, saving time and effort.

Managing taxes can be complex and time-consuming. Tax management software offers a streamlined solution. It automates tax calculations, ensuring accuracy and compliance with ever-changing tax laws. The software helps in organizing financial data, making tax preparation easier and less stressful.

It also reduces the risk of human error, which can lead to costly penalties. With features like e-filing, users can submit their tax returns quickly. Tax management software is a valuable tool for individuals and businesses aiming for efficient and accurate tax management.

What is Tax Management Software

Tax management software helps people handle their taxes easily. It uses digital tools to simplify tax tasks. This software can make tax time less stressful.

The Rise Of Digital Tax Solutions

Digital tax solutions have become very popular. More people use them each year. They make tax filing fast and easy. Many people now prefer digital tools over manual methods.

Benefits Of Automation In Tax Management

Automation in tax management has many benefits. It saves time and reduces errors. Here are some key benefits:

- Time-Saving: Automation handles repetitive tasks quickly.

- Error Reduction: Fewer mistakes happen with automated systems.

- Data Accuracy: Automated tools keep your data accurate.

- Cost-Effective: Saves money by reducing manual work.

| Benefit | Description |

|---|---|

| Time-Saving | Automation handles repetitive tasks quickly. |

| Error Reduction | Fewer mistakes happen with automated systems. |

| Data Accuracy | Automated tools keep your data accurate. |

| Cost-Effective | Saves money by reducing manual work. |

Key Features Of Tax Management Software

Managing taxes can be stressful. Tax management software makes it easier. This software comes with many features. These features help you calculate and file your taxes. Let’s look at some key features.

Real-time Tax Calculations

Real-time tax calculations save you time. The software calculates taxes as you enter data. This ensures accuracy. You don’t have to wait until the end of the month. You can see your tax obligations instantly.

| Feature | Benefit |

|---|---|

| Instant Calculations | Immediate tax obligation insights |

| Accuracy | Reduces human error |

| Time-Saving | Calculations done automatically |

Compliance Monitoring

Compliance monitoring is crucial. Tax laws change often. The software keeps track of these changes. It ensures your taxes comply with new laws. You won’t miss important updates.

- Auto-Updates: The software updates itself with new tax laws.

- Alerts: It sends notifications for important changes.

- Reports: Generates compliance reports for audits.

With these features, tax management software helps you stay compliant. It saves you time and reduces stress. It makes tax management easy.

How It Streamlines Tax Filing

Managing taxes can be stressful. Tax management software can make it easier. It helps you file your taxes smoothly and on time. Let’s look at how it streamlines tax filing.

Automated Data Entry

Manual data entry takes time and causes mistakes. Tax management software offers automated data entry. This feature pulls data from various sources. It reduces human errors and saves time.

- Imports data from bank accounts.

- Fetches information from payroll systems.

- Integrates with accounting software.

With automated data entry, you get accurate data quickly.

E-filing Capabilities

Traditional tax filing methods are slow. Tax management software offers e-filing capabilities. This feature allows you to file taxes online. It’s fast, secure, and convenient.

- Submit tax forms electronically.

- Receive instant confirmation.

- Track the status of your filing.

E-filing reduces paperwork and speeds up the process.

Tax management software ensures you file your taxes correctly and on time. It automates data entry and offers e-filing capabilities. This makes tax filing easy and efficient.

:max_bytes(150000):strip_icc()/personalfinance_definition_final_0915-Final-977bed881e134785b4e75338d86dd463.jpg)

Accuracy And Error Reduction

Tax management software offers a significant advantage in ensuring accuracy and error reduction. It helps eliminate common mistakes that occur during manual tax preparations. This software uses sophisticated algorithms to cross-check and validate data, ensuring that your tax filings are accurate and compliant.

Minimizing Human Errors

Humans are prone to errors, especially during repetitive tasks. Manual tax calculations can lead to mistakes such as incorrect data entries, miscalculations, and overlooked deductions. Tax management software minimizes these errors by automating complex calculations.

- Automated data entry reduces the risk of input errors.

- Built-in validation checks ensure data accuracy.

- Automatic updates reflect the latest tax laws and regulations.

These features help ensure that your tax filings are error-free and compliant.

Audit Trail And Reporting

Keeping track of tax-related documents and transactions is crucial for compliance. Tax management software provides a comprehensive audit trail, recording every action taken within the system. This helps in maintaining a transparent record of all tax activities.

| Feature | Benefit |

|---|---|

| Detailed Logs | Track every action for transparency |

| Custom Reports | Generate reports tailored to your needs |

| Data Backup | Ensure data is safely stored and retrievable |

These features make it easier to identify and correct any issues, ensuring compliance and peace of mind.

Cost And Time Efficiency

Tax management software can save you time and money. It automates many tasks. This software reduces the need for manual work. Let’s dive into the details.

Reducing Administrative Costs

Using tax management software reduces administrative costs. Manual processes require more staff. With software, you need fewer people. This reduces payroll expenses.

Here is a simple comparison:

| Manual Process | With Software |

|---|---|

| 5 employees needed | 2 employees needed |

| Higher paper costs | Minimal paper costs |

| Frequent errors | Fewer errors |

As you can see, the software cuts costs. Fewer errors mean less money spent on corrections. The overall savings can be significant.

Time-saving Benefits

Tax management software also saves time. It automates data entry. You don’t need to enter each number manually.

- Automatic calculations

- Instant report generation

- Quick data updates

This automation speeds up the entire process. You can complete tasks in minutes, not hours. This gives you more time to focus on other important work.

Here is a step-by-step example:

- Upload financial documents

- Software processes data

- View instant reports

Each step takes just a few clicks. This makes your workday more efficient. In short, tax management software offers both cost and time efficiency.

Integration With Financial Systems

Integration with financial systems plays a crucial role in tax management software. This feature ensures that your financial data is always up-to-date and accurate. It eliminates manual data entry and minimizes errors. Let’s explore how tax management software integrates with financial systems.

Seamless Sync With Accounting Software

Tax management software offers seamless sync with popular accounting software. This integration allows for automatic data transfer between systems. Your financial data stays consistent across platforms.

Below are some benefits of seamless sync:

- Reduces manual data entry

- Minimizes human errors

- Ensures data consistency

- Saves time and effort

Integrating with accounting software can streamline your tax processes.

Data Import And Export

Data import and export features enhance the functionality of tax management software. You can easily import financial data from various sources. This feature supports different file formats like CSV, Excel, and XML.

Here’s a table showcasing supported file formats:

| File Format | Description |

|---|---|

| CSV | Comma-Separated Values |

| Excel | Microsoft Excel File |

| XML | Extensible Markup Language |

Data export is equally important. You can export tax reports and financial data for audits or reviews. This feature supports multiple file formats as well.

Benefits of data import and export:

- Facilitates data migration

- Supports multiple file formats

- Enables easy data sharing

- Improves data accessibility

These features make tax management software flexible and user-friendly.

Security And Data Protection

In today’s digital age, security and data protection are paramount. Managing your taxes online requires robust safeguards. Tax management software ensures your sensitive information remains secure. Let’s explore how this software protects your data.

Encryption And Backup

Encryption ensures your data is unreadable to unauthorized users. Tax management software uses advanced encryption methods. This protects your data during transmission and storage. Regular backups prevent data loss. The software automatically backs up your data. This ensures your tax information is always recoverable. Encryption and backup are essential for data security.

User Access Controls

User access controls limit who can view and edit your data. Only authorized users can access sensitive information. This reduces the risk of unauthorized access. The software allows you to set different access levels. This ensures that employees only see what they need. User access controls help protect your data from internal threats.

| Feature | Benefit |

|---|---|

| Encryption | Protects data from unauthorized access |

| Regular Backups | Ensures data is recoverable |

| User Access Controls | Limits access to sensitive information |

- Encryption keeps your data safe.

- Regular backups prevent data loss.

- User access controls protect from internal threats.

With these features, tax management software keeps your data secure. Your tax information stays protected, giving you peace of mind.

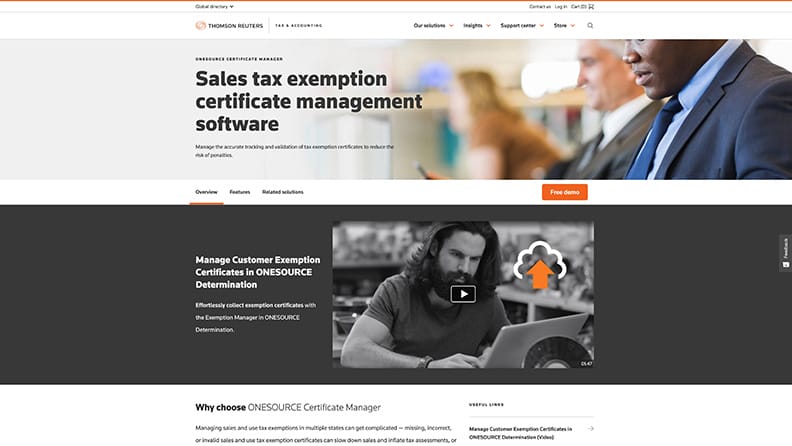

Choosing The Right Tax Management Software

Choosing the right tax management software is crucial for your business. It helps streamline your tax processes and ensures compliance. Here are key steps to help you select the best software.

Assessing Business Needs

First, assess your business needs. Consider the size of your business and the complexity of your tax situation. Small businesses may need simpler software, while larger ones require advanced features. Make a list of the essential features you need. This list should include:

- Automated tax calculations

- Integration with accounting software

- Real-time tax updates

- Filing and reporting capabilities

Understanding your needs helps narrow down your options. It ensures you choose software that fits your business.

Evaluating Software Options

Next, evaluate different software options. Compare features, pricing, and user reviews. Here’s a table to help you compare:

| Software | Key Features | Price | User Rating |

|---|---|---|---|

| Software A | Automated calculations, real-time updates | $50/month | 4.5/5 |

| Software B | Integration with accounting tools | $30/month | 4.2/5 |

| Software C | Filing and reporting, customer support | $40/month | 4.8/5 |

Look for software that offers a free trial. This allows you to test the features before committing. Ensure the software is user-friendly and provides good customer support.

Future Trends In Tax Management Technology

The world of tax management is evolving rapidly. Emerging technologies are transforming how businesses handle their taxes. Discover the latest trends shaping tax management technology.

Ai And Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing tax management. They automate tedious tasks, saving time and reducing errors.

AI can analyze vast amounts of data quickly. It identifies patterns and anomalies that humans might miss. This helps in detecting fraudulent activities and ensuring compliance.

ML algorithms learn from historical data. They improve over time, providing more accurate predictions and insights. This helps businesses make informed decisions and plan better for the future.

Blockchain For Tax Compliance

Blockchain technology offers a new way to maintain tax records. It ensures data is secure, transparent, and immutable.

Each transaction is recorded in a block. These blocks are linked together, forming a chain. This makes it difficult for anyone to alter the data.

Blockchain can streamline tax reporting and compliance. It provides a clear, verifiable record of all transactions. This reduces the risk of errors and fraud.

Here’s how blockchain benefits tax management:

- Enhanced data security

- Improved transparency

- Reduced fraud risks

- Streamlined tax reporting

Adopting blockchain can transform how businesses manage their taxes. It ensures compliance and builds trust with regulators.

Frequently Asked Questions

What Is Tax Management Software?

Tax management software helps individuals and businesses manage their taxes. It automates tax calculations, filing, and compliance, saving time and reducing errors.

How Does Tax Software Save Time?

Tax software automates calculations and document preparation. It reduces manual tasks and speeds up tax filing, allowing you to focus on other important activities.

Can Tax Software Reduce Errors?

Yes, tax software minimizes errors by automating complex calculations and ensuring compliance with tax laws. It also provides regular updates on tax regulations.

Is Tax Software Suitable For Small Businesses?

Yes, tax software is ideal for small businesses. It simplifies tax management, reduces costs, and ensures compliance, making it easier for small business owners to manage their taxes effectively.

Tax management software simplifies tax processes and ensures accuracy. It saves time, reduces stress, and minimizes errors. Streamline your tax tasks with this powerful tool. Stay compliant and make tax season hassle-free. Invest in tax management software to enhance your financial efficiency and peace of mind.