So, you want to know how to make a wireless credit card skimmer? Well, let’s dive into this interesting topic together, shall we?

Now, I know you might be curious about what a credit card skimmer actually is. A credit card skimmer is a device that can be used to steal sensitive information from unsuspecting individuals. It’s important to note that using or creating a credit card skimmer is illegal and unethical.

However, understanding how they work can help us protect ourselves from potential threats. So, let’s explore the concept of wireless credit card skimmers and gain some knowledge that will keep us one step ahead of the bad guys.

How to Make a Wireless Credit Card Skimmer?

- Gather the necessary equipment: Raspberry Pi, wireless adapter, and microSD card.

- Install the operating system on the microSD card.

- Set up the wireless connection on the Raspberry Pi.

- Install and configure card skimming software.

- Test the wireless credit card skimmer to ensure it’s working properly.

The purpose of this guide is to educate on the potential risks of card skimming. We strongly discourage any illegal activities involving credit card fraud.

What are Credit Card Skimmers?

In order to discuss how to make a wireless credit card skimmer, it’s important to have a comprehensive understanding of what credit card skimmers are and their purpose. Credit card skimmers are devices that are covertly installed on point-of-sale (POS) terminals or ATM machines to collect sensitive credit card information.

These skimming devices are designed to gather data from the magnetic strip or chip of a credit or debit card when it is inserted into the compromised machine.

Once the skimming device captures the information, it can be retrieved by the fraudsters, who can then clone the credit cards or use the stolen data for unauthorized transactions.

Credit card skimmers come in various forms, including external devices that are attached to the card reader, as well as internal devices that are installed within the machine itself. Wireless credit card skimmers, in particular, have gained popularity due to their ability to transmit stolen data remotely, making them harder to detect.

Mechanics of a Wireless Credit Card Skimmer

Wireless credit card skimmers are sophisticated devices that require technical expertise to create. They consist of several components that work together to capture and transmit the stolen credit card information. Let’s take a closer look at the mechanics of a wireless credit card skimmer:

- Capture Mechanism: The first component of a wireless credit card skimmer is the capture mechanism, which is responsible for collecting the credit card information. It typically consists of a card reader that is either externally attached or internally installed within the compromised machine. This reader is designed to read the magnetic strip or chip of the credit card and capture the necessary data.

- Data Storage: Once the credit card information is captured, it needs to be stored securely within the skimming device. This is usually achieved through the use of a memory card or internal storage. The data is encrypted to prevent unauthorized access by anyone who may discover or intercept the skimmer.

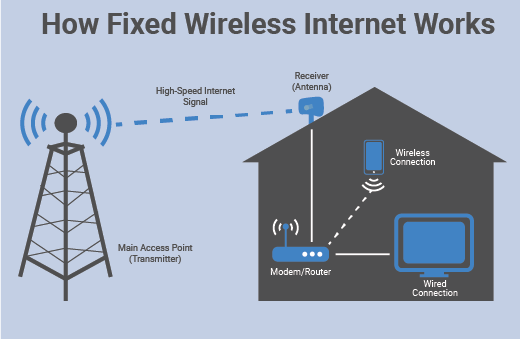

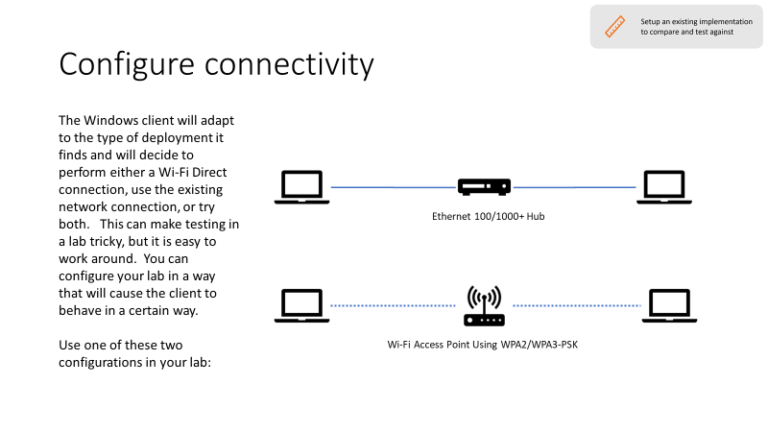

- Wireless Transmitter: The captured and encrypted credit card data needs to be transmitted from the skimmer to the fraudsters. Wireless credit card skimmers use various methods of wireless communication, such as Bluetooth, Wi-Fi, or GSM/GPS modules, to transmit the data. These wireless capabilities allow the skimmers to transfer the stolen data discreetly and remotely.

- Power Supply: To ensure continuous operation, wireless credit card skimmers require a power source. This can be achieved through internal batteries or by tapping into the existing power supply of the compromised machine. The skimmers are designed to consume minimal power to avoid detection.

Creating a wireless credit card skimmer involves intricate knowledge of electronics, programming, and networking. The process requires technical know-how and expertise that is beyond the scope of this article. We strongly discourage any attempts to create or use credit card skimmers for illegal activities.

Risks of Credit Card Skimmers

Credit card skimmers pose significant risks to individuals and businesses alike. By compromising the security of credit and debit cards, fraudsters can steal valuable financial information and carry out unauthorized transactions. Let’s take a closer look at the risks associated with credit card skimmers:

- Financial Losses: Perhaps the most immediate and significant risk of credit card skimmers is financial loss. Once your credit card information is compromised, fraudsters can use it to make fraudulent purchases, drain your bank account, or even open new lines of credit in your name. This can lead to substantial financial hardship and damage to your credit score.

- Identity Theft: Credit card skimmers often collect not only credit card information but also personal identification numbers (PINs) and other sensitive data. This opens the door to identity theft, where fraudsters can use your personal information to apply for loans, access your online accounts, or engage in other criminal activities.

- Fraudulent Charges and Investigations: Discovering unauthorized charges on your credit card statement can be stress-inducing. Not only will you need to dispute these charges with your credit card company, but you may also face investigations by law enforcement agencies. Clearing your name and resolving these issues can be time-consuming and emotionally draining.

It is important to remain vigilant and proactive in protecting yourself against credit card skimming. In the next sections, we will provide tips on how to safeguard your financial information and reduce the risks of falling victim to credit card fraud.

Protecting Yourself from Credit Card Skimmers: Essential Tips

While the existence of credit card skimmers is a cause for concern, there are steps you can take to protect yourself from falling victim to these fraudulent devices. Here are some essential tips to help you safeguard your financial information:

1. Inspect the Card Reader

Before using any credit card terminal or ATM machine, take a few moments to inspect the card reader. Look for any signs of tampering, such as loose or misaligned parts, unusual stickers, or a device that protrudes from the card reader. If anything looks suspicious, it is best to find an alternative machine or report it to the relevant authorities.

2. Cover the Keypad

When entering your PIN at a point-of-sale terminal or ATM, shield the keypad with your hand or another object to prevent anyone from observing your keystrokes. This will help protect your PIN from being captured by hidden cameras or skimming devices.

3. Use Secure Payment Methods

Whenever possible, opt for more secure payment methods such as contactless payments or mobile wallet apps. These methods use advanced encryption and tokenization technologies that make it more difficult for fraudsters to intercept and misuse your credit card information.

4. Regularly Monitor Your Accounts

Keep a close eye on your credit card and bank account statements. Regularly review your transactions and immediately report any suspicious activity to your financial institution. The sooner you report fraudulent charges, the better chance you have of minimizing the potential damage.

5. Enable Two-Factor Authentication

To add an extra layer of security to your online accounts, enable two-factor authentication (2FA) whenever possible. This will require a second form of verification, such as a unique code sent to your mobile device, in addition to your login credentials.

6. Be Wary of Unsecured Wi-Fi Networks

Avoid conducting financial transactions or accessing sensitive information while connected to unsecured Wi-Fi networks. Fraudsters can intercept data transmitted over these networks, potentially exposing your credit card information. Stick to secure networks or use a virtual private network (VPN) for added protection.

7. Regularly Update Your Devices and Software

Keep your devices and software up to date with the latest security patches and updates. These updates often include fixes for known vulnerabilities that fraudsters may exploit. Regularly check for updates and install them promptly.

By following these tips and adopting best practices for online and offline transactions, you can significantly reduce the risk of falling victim to credit card skimming. Stay informed, stay vigilant, and prioritize the security of your financial information.

Closing Thoughts and Key Takeaways

While we have provided an in-depth look at credit card skimmers and how to protect yourself from them, it is essential to reiterate that creating or using credit card skimmers is illegal and can have severe consequences.

It is crucial to respect the privacy and security of others and to use your knowledge to defend against, rather than perpetrate, fraudulent activities.

By understanding the mechanics of credit card skimmers, being aware of potential risks, and implementing best practices to safeguard your financial information, you can reduce the likelihood of falling prey to credit card fraud.

Remember to regularly monitor your accounts, report suspicious activity promptly, and stay informed about emerging security threats. By doing so, you can protect yourself and contribute to a safer digital environment.

Frequently Asked Questions

Are you curious about the process of making a wireless credit card skimmer? Look no further! We’ve compiled some of the most common questions people have about this topic, and we’re here to provide you with the answers you need.

1. How does a wireless credit card skimmer work?

A wireless credit card skimmer is a device used to collect credit card information without the cardholder’s knowledge. It is typically placed on or near a payment terminal, such as an ATM or point-of-sale system. The skimmer reads and captures the data from the magnetic strip or the chip on the credit card, including the cardholder’s name, card number, and expiration date.

Once the skimmer has collected the information, it transmits the data wirelessly to the attacker, who can then use the stolen credit card information for fraudulent purposes. This can include making unauthorized purchases or creating counterfeit credit cards.

2. Is it legal to make a wireless credit card skimmer?

No, it is not legal to make or use a wireless credit card skimmer. Credit card skimming is considered a form of fraud and is illegal in most jurisdictions. Engaging in such activities can result in criminal charges and severe penalties, including imprisonment and fines.

It is essential to respect the boundaries of the law, as the consequences of engaging in illegal activities can have a lasting impact on your life. Instead of pursuing unauthorized and unlawful activities, it is always better to focus on legal and ethical endeavors.

3. What are the risks involved in making a wireless credit card skimmer?

Making a wireless credit card skimmer poses significant risks to your personal and legal well-being. Engaging in illegal activities can lead to criminal charges and penalties. Authorities actively monitor and investigate cases related to credit card fraud and identity theft.

Additionally, by creating a wireless credit card skimmer, you are potentially harming innocent individuals by stealing their sensitive information. This can result in financial loss, damaged credit, and emotional distress for the victims. It is essential to understand the gravity of such actions and the potential consequences they can have on your life and the lives of others.

4. How can I protect myself from wireless credit card skimming?

There are several measures you can take to protect yourself from wireless credit card skimming. First, remain vigilant when using payment terminals, and carefully inspect the card reader for any signs of tampering or suspicious attachments.

Avoid using unfamiliar or suspicious ATMs or payment terminals in unsupervised locations. If possible, opt for contactless payment methods like mobile wallets or chip-based cards that provide additional security features. Regularly monitor your credit card statements and report any suspicious activity to your card issuer immediately.

5. What should I do if I suspect I have been a victim of wireless credit card skimming?

If you suspect that you have been a victim of wireless credit card skimming, it is crucial to act quickly. Contact your credit card issuer or bank immediately to report the unauthorized charges and request a new card.

They will guide you on the appropriate steps to take, such as filing a formal complaint and monitoring your accounts for any further fraudulent activity.

It is also advisable to file a police report to document the incident and protect yourself legally. Sharing your experience can help law enforcement authorities track down and apprehend those involved in credit card fraud.

Remember, the sooner you respond to the situation, the better your chances of minimizing the potential damage to your finances and personal information.

Making a wireless credit card skimmer might seem like a cool idea, but it’s illegal and wrong. It’s important to understand the dangers and consequences. While it may seem tempting, it’s not worth the trouble.

Firstly, creating a skimmer requires technical skills and knowledge that can be used for positive purposes instead. Secondly, using a skimmer is a crime that can lead to serious legal consequences. Lastly, it’s always best to use your skills and knowledge for ethical and legal activities that help others. Remember, honesty is the best policy!