Credit Cards in India: Having to live the grand and comfortable lifestyle that you want is exciting and fulfilling. Owning a credit card allows a prestigious lifestyle particularly for those who are living in the Metro cities of India. For the many years, the use of credit cards is getting more of a desire and need especially with the growing development of the E-commerce industry.

List Of Top 10 Credit Cards in India

With the capability of splurging and paying later, more people opted on using credit cards than any other payment method. In addition to that, credit card companies are constantly improving and adding amazing benefits in order to attract and retain their clients. For those who are looking for the best credit cards in India, here are the top 10 list together with the benefits that each one has to offer to their clients.

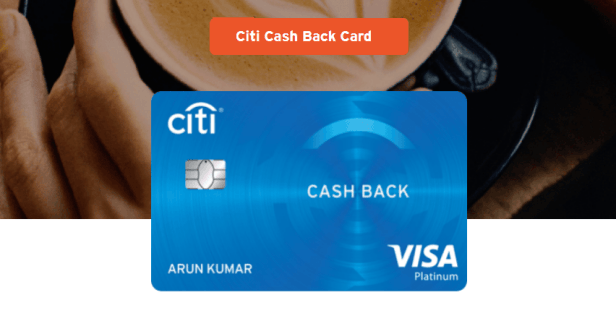

1.) Citibank Cashback Credit Card (Rs.500/year)

This Citibank credit card offers cashback for purchases made using this card, hence the name. It provides a 5% cashback when you use it to purchase movie ticket/s or on paying utility bills such as postpaid mobile bills, water bills, or electricity bills. Additionally, for any other expenditures with this card, you are guaranteed with 0.5% cashback. On top of that, your cash backs don’t expire and it will be automatically credited. Not only you will get deals and discounts locally, but also in many other countries that offer Citi World Privileges. More of the benefits include the conversion of bigger purchases into small payments or installments and instant loans on cards.

2.) Standard Chartered Manhattan Platinum Credit Card (Rs.999/year)

One of the most favored and popular credit cards in India for reward points, shopping, cashback and dining out. It is well-known for giving 5% cashback on grocery purchases in any stores such as Reliance Fresh, More, and Big Bazaar. It can save you a lot of money especially if you frequently shop at the stores mentioned above. This credit card also provides 5x reward points when used in dining out, buying tickets, or for filling petrol. Lastly, it offers BookMyShow vouchers worth Rs. 2,00 when you make your first purchase within the first 90 days of acquiring this card.

3.) ICICI Instant Platinum Credit Card (No annual fee)

ICICI bank proposes ICICI Instant Platinum Credit Card to those who are self-employed, students, a homemaker or have a bad credit history because of reasons like a financial crisis. This is one of the easiest and appropriate cards for those who are mention above for you will be able to hold a fixed deposit without presenting a financial document. This credit card also offers a 15% discount to about 800 restaurants and diners all around India. Moreover, you will also receive discounts of up to Rs. 100 if you purchase a movie ticket, 2 payback points on every Rs. 100 spent, and 1 payback points on every Rs. 100 spent on insurance and utilities. Points are redeemable on a variety of gifts. On top of all the good benefits, this credit card charges zero or no yearly fees.

4.) IndianOil Citi Platinum Credit Card(Rs. 1,000/year for annual spend of below Rs. 30,000)

This is a must-have credit card for those who charge their fuels regularly. This card allows you to earn 4 turbo points on every Rs. 150 spent on fuel at any Indian Oil outlet all over India. These points can be redeemed as free fuel or gift vouchers. You can also earn points from other purchases such as 1 turbo point for every Rs. 150 spent on shopping and dining and 2 turbo points at all supermarkets and grocery stores.

5.) HSBC Visa Platinum Card

From cashback, discounts, and reward points, this credit card has a lot to offer. 10% cashback is entitled to all transactions during the first 3 months provided that a transaction worth more than Rs. 10,000 is spent at least 3 times. Also, for every Rs. 150 spent on any purchases 2 points will be earned and triple reward points for leisure and dining transactions.

6.) SimplyCLICK SBI Card (Rs. 499/year)

The essential card for those who are a fan of shopping at Amazon, Cleartrip, Bookmyshow, Zoomcar and any other online e-commerce associated with this credit card. You can get up to 10x reward points at these shops and 5x reward points at any other online shops or stores.

7.) AXIS Bank Neo Credit Card (Rs. 250)

The credit card option for those who are looking at dining, shopping, and entertainment benefits. This card gives 10% cashback for online shopping, mobile recharges, and movie ticket bookings. This also provides a minimum of 15% off on their partner restaurants and Amazon voucher worth Rs. 250 on the first purchase.

8.) HDFC Bank Diners Club Card (Rs. 5,000/year + applicable taxes)

One of the best credit card for those who love to travel. This card can give you up to 2x reward points on air ticket and hotel bookings not only in India or locally but also internationally. As a premium cardholder, you are entitled to airport lounges access and earn 5 reward points for every Rs. 150 worth of transactions. Earned points can be redeemed as air tickets or hotel bookings.

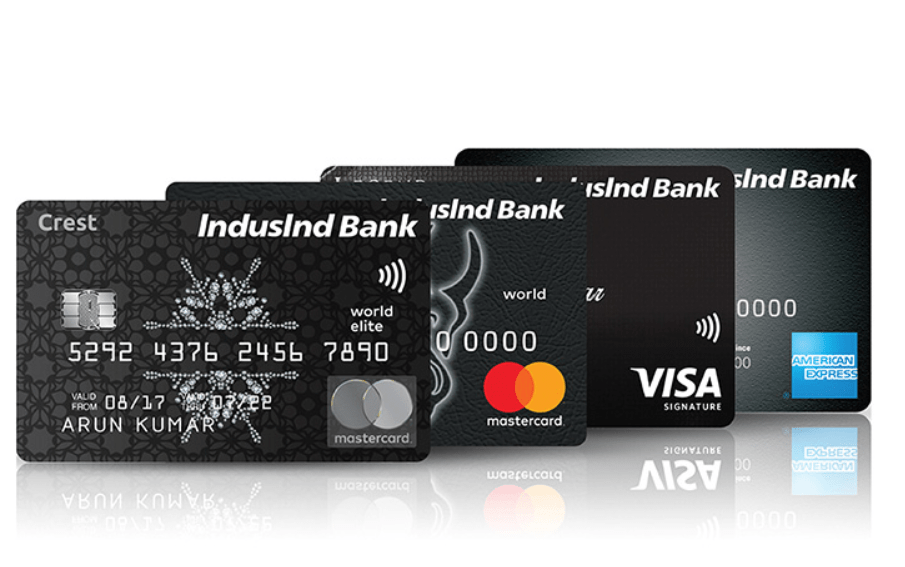

9.) IndusInd Bank Platinum Credit Card

This credit card is for those who are into luxurious dining and lifestyle benefits. Discounts are offered on every transaction at partner e-commerce shops like Bookmyshow or travel and shopping partners such as Satya Paul, United Colors of Benetton, Jet Airways and many more. A 1.5 reward point is earned every Rs. 150 worth of purchase or transaction. Additionally, Rs. 25 Lakhs of travel insurance is also offered by this credit card and this also gives you access to a Priority Pass Membership.

10.) SBI CARD Elite (Rs. 4,999/year)

This card is also designed to offer hotel and travel discounts, complimentary international lounge access, Club Vistara, and Trident Privilege Membership. It offers earnings of up to Rs. 12,500 worth of bonus reward points per year. In addition to that, this card provides a Rs 5,000 welcome gift and 9 Club Vistara point on every Rs. 100 spent on Vistara flights.