Travel insurance offers financial protection and peace of mind for frequent travelers. It covers unexpected events like medical emergencies and trip cancellations.

Frequent travelers face various risks during their journeys. Travel insurance helps manage these risks by offering coverage for medical emergencies, trip cancellations, lost baggage, and other unforeseen events. It provides financial security and ensures assistance when needed. Travel insurance also covers delays, missed connections, and personal liability.

This protection allows frequent travelers to focus on enjoying their trips without worrying about unexpected costs. By investing in travel insurance, travelers safeguard their health, belongings, and overall travel experience.

Importance Of Travel Insurance

Travel insurance is essential for frequent travelers. It provides safety and peace of mind. Traveling often means more chances of unexpected events. Travel insurance can help protect against these risks.

Protecting Against Unforeseen Events

Travel insurance covers many unexpected events. These events can include medical emergencies, trip cancellations, and lost baggage. Imagine you get sick in a foreign country. Medical expenses can be very high. Travel insurance can cover these costs.

Travel insurance also helps with trip cancellations. Sometimes, emergencies can force you to cancel trips. Without insurance, you might lose a lot of money. Insurance can help you get a refund.

Lost baggage is another common problem. Losing your luggage can ruin your trip. Travel insurance can help you recover your lost items or get compensation.

Peace Of Mind For Travelers

Travel insurance provides peace of mind. Knowing you are covered helps you relax. You can enjoy your trip without worrying about unexpected issues.

Traveling can be stressful. Worrying about potential problems adds to the stress. With insurance, you can focus on enjoying your journey. You know you are protected.

Travel insurance also helps in emergencies. If something goes wrong, you have support. You can get help quickly and efficiently. This support makes your travel experience much better.

| Benefit | Description |

|---|---|

| Medical Coverage | Covers medical expenses during travel. |

| Trip Cancellation | Refunds costs if you cancel your trip. |

| Lost Baggage | Compensates for lost or delayed luggage. |

- Protects against unexpected events.

- Provides peace of mind for travelers.

- Helps with medical emergencies and trip cancellations.

- Covers lost baggage and other issues.

Types Of Travel Insurance

Travel insurance is essential for frequent travelers. It offers peace of mind by covering unexpected events. There are various types of travel insurance, each designed to cater to specific needs. In this section, we will explore two main types: Medical Coverage and Trip Cancellation.

Medical Coverage

Medical coverage is vital for travelers. It covers medical emergencies abroad. These emergencies can include accidents, illnesses, and other health issues. Without insurance, medical costs can be high. This type of insurance covers:

- Hospitalization: Covers hospital stays and treatment.

- Emergency Evacuation: Covers transportation to the nearest hospital.

- Medical Repatriation: Covers returning home for further treatment.

- Prescription Drugs: Covers the cost of essential medications.

Medical coverage ensures you receive timely care. It also prevents financial stress during emergencies.

Trip Cancellation

Trip cancellation insurance protects your travel investment. It covers non-refundable expenses if your trip gets canceled. There are many valid reasons for trip cancellation:

- Illness or Injury: Covers cancellations due to health issues.

- Weather Events: Covers cancellations due to severe weather.

- Work Obligations: Covers cancellations due to work commitments.

- Family Emergencies: Covers cancellations due to family issues.

Trip cancellation insurance reimburses prepaid costs. These costs can include flights, hotels, and tours. This type of insurance ensures you don’t lose money on unforeseen events.

Here’s a table summarizing the benefits:

| Type of Coverage | Benefits |

|---|---|

| Medical Coverage | Hospitalization, Emergency Evacuation, Medical Repatriation, Prescription Drugs |

| Trip Cancellation | Illness or Injury, Weather Events, Work Obligations, Family Emergencies |

Travel insurance provides peace of mind. It ensures you are covered in unexpected situations.

Coverage For Frequent Travelers

Frequent travelers often face unique challenges. Travel insurance can be a lifesaver. It offers protection against unexpected events. Let’s explore the benefits and coverage options.

Annual Multi-trip Plans

For frequent travelers, annual multi-trip plans are cost-effective. These plans cover multiple trips within a year. This saves both time and money.

- Unlimited Trips: Travel as many times as you want.

- Cost-Effective: Cheaper than buying individual trip insurance.

- Comprehensive Coverage: Covers medical emergencies, cancellations, and lost luggage.

These plans are ideal for business travelers. They are also great for avid explorers. One policy covers all your trips.

Customizing Your Policy

Travel needs vary. Customizing your policy ensures you get the right coverage. Here’s how you can tailor your travel insurance:

- Select Coverage Limits: Choose limits based on your needs.

- Add-Ons: Include specific covers like adventure sports or rental car protection.

- Destination Specific: Customize based on travel destinations.

By customizing, you ensure comprehensive protection. This makes your travels worry-free and enjoyable.

| Feature | Annual Multi-Trip Plans | Customizing Your Policy |

|---|---|---|

| Unlimited Trips | Yes | Depends on selection |

| Cost-Effective | Yes | Varies |

| Comprehensive Coverage | Yes | Yes |

Common Risks Covered

Frequent travelers face many risks during their journeys. Travel insurance can offer peace of mind. It covers many common risks that travelers encounter. Below, we discuss some of these risks.

Lost Luggage

Losing luggage can ruin a trip. Travel insurance helps in such situations. It provides coverage for lost, stolen, or damaged luggage. This means you can replace your essential items quickly.

Some policies also cover delayed luggage. If your bags are delayed, you can buy necessary items. This makes your trip less stressful.

Flight Delays

Flight delays are common and frustrating. Travel insurance can help here as well. It covers expenses for meals, lodging, and other essentials. This is useful if your flight gets delayed for long hours.

Some policies also cover missed connections. If a delay causes you to miss a connecting flight, insurance can help. It covers the cost of rebooking and accommodation. This ensures your journey continues smoothly.

| Common Risks | Coverage |

|---|---|

| Lost Luggage | Reimbursement for lost, stolen, or damaged bags |

| Flight Delays | Expenses for meals, lodging, and rebooking |

Travel insurance is essential for frequent travelers. It covers common risks like lost luggage and flight delays. This makes your trips safer and more enjoyable.

Choosing The Right Policy

Frequent travelers need the right travel insurance policy. It ensures their trips are smooth and stress-free. But how do you choose the right one? This section will guide you through the essential steps.

Assessing Your Needs

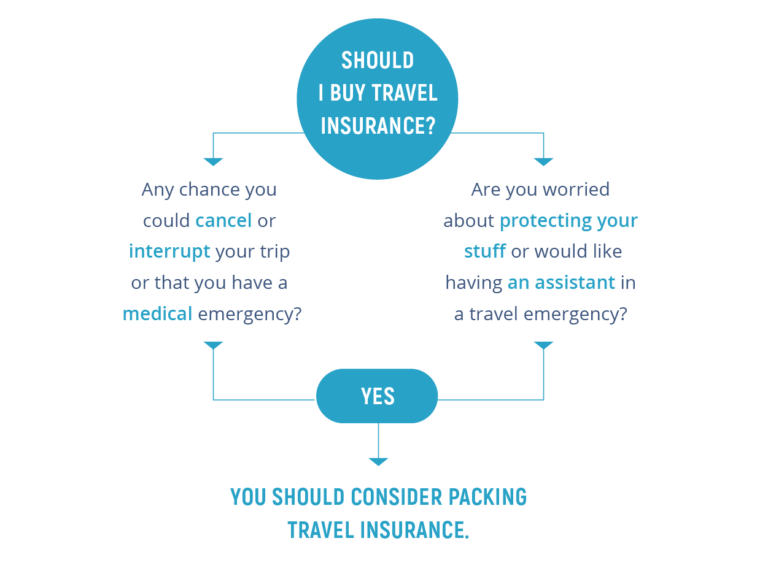

First, assess your travel needs. List the destinations you visit often. Consider the activities you engage in during your trips. Do you participate in extreme sports or visit remote areas?

Next, think about your health. Do you have any pre-existing medical conditions? Make sure the policy covers these. Also, determine the duration of your trips. Some policies are better for short trips, while others suit long stays.

Here’s a quick checklist to assess your needs:

- Frequent destinations

- Types of activities

- Health conditions

- Trip duration

Comparing Providers

Once you know your needs, compare different insurance providers. Check the coverage they offer. Look for policies that cover medical emergencies, trip cancellations, and lost baggage.

Read customer reviews. They provide insights into the company’s reliability. Also, compare the cost of different policies. Sometimes, a cheaper policy may not offer enough coverage.

Here’s a comparison table to help you:

| Provider | Coverage | Cost | Customer Reviews |

|---|---|---|---|

| Provider A | Medical, Trip Cancellation, Lost Baggage | $200/year | 4.5 stars |

| Provider B | Medical, Trip Interruption, Lost Baggage | $250/year | 4 stars |

| Provider C | Medical, Trip Cancellation, Emergency Evacuation | $300/year | 5 stars |

Use these steps to find the perfect travel insurance for your needs. It will make your travel experiences worry-free.

Making A Claim

As a frequent traveler, knowing how to make a claim on your travel insurance is essential. Understanding the process ensures you get reimbursed quickly and efficiently for any unexpected events.

Documentation Required

Having the correct documents is crucial for a smooth claim process. Gather the following:

- Policy number

- Proof of travel (tickets, itineraries)

- Receipts for any expenses

- Medical reports if claiming for health reasons

- Police reports for theft or loss claims

Ensure all documents are clear and legible. Digital copies are often acceptable but check with your insurer.

Claim Process Steps

Follow these steps to make a successful claim:

- Contact your insurer immediately after the incident.

- Fill out the claim form provided by your insurer.

- Attach all required documents to the form.

- Submit the form through the insurer’s preferred method.

- Wait for confirmation and further instructions from your insurer.

Keep track of all communications with your insurer. This helps in case of any disputes or delays.

Tips For Frequent Travelers

Travel insurance is essential for frequent travelers. It provides peace of mind on the go. Here are some key tips to help frequent travelers make the most of their journeys.

Staying Healthy

Maintaining health is crucial while traveling. Here are some tips:

- Stay hydrated: Drink plenty of water.

- Eat balanced meals: Choose nutritious food over junk.

- Rest well: Ensure you get enough sleep.

- Exercise: Take time to stretch or walk daily.

These simple habits can prevent many travel-related health issues. Keep your body and mind in top shape.

Keeping Important Contacts

Keeping important contacts handy is vital. Here are some tips:

- Emergency contacts: Keep a list of emergency numbers.

- Travel insurance contacts: Have your insurer’s contact details.

- Local contacts: Note down local embassy or consulate numbers.

- Family and friends: Share your itinerary with them.

Having these contacts can help in emergencies. Ensure they are easily accessible.

| Contact Type | Details |

|---|---|

| Emergency Contacts | Local police, ambulance, fire department numbers |

| Travel Insurance Contacts | Insurance company helpline and policy number |

| Local Contacts | Embassy, consulate, and local assistance numbers |

| Family and Friends | Contact details of close family and friends |

By following these tips, frequent travelers can stay healthy and safe. Travel insurance can assist in unforeseen situations, making your journey worry-free.

Cost Considerations

Understanding the cost considerations of travel insurance is crucial for frequent travelers. By evaluating the costs, you can make informed decisions. This will help you protect your journey and finances.

Budgeting For Insurance

First, set aside a budget for travel insurance. This ensures you allocate funds specifically for this purpose. To help you plan, consider the following:

- Average cost of travel insurance

- Destination-specific insurance costs

- Trip duration and frequency

Here’s a simple table to guide you:

| Trip Type | Insurance Cost (Approx.) |

|---|---|

| Single Trip | $30 – $50 |

| Annual Multi-Trip | $300 – $500 |

Weighing Costs Vs. Benefits

Evaluate the costs vs. benefits of travel insurance. Consider the following factors:

- Coverage for medical emergencies

- Reimbursement for trip cancellations

- Protection against lost luggage

Benefits often outweigh the costs, especially for frequent travelers. For example, a medical emergency abroad can cost thousands. Travel insurance can cover these expenses, saving you money.

In summary, careful consideration of costs and benefits ensures you get the most value. This approach helps you travel with peace of mind.

Frequently Asked Questions

What Is Travel Insurance For Frequent Travelers?

Travel insurance for frequent travelers offers coverage for multiple trips. It typically includes medical emergencies, trip cancellations, and lost luggage. This type of insurance ensures peace of mind for frequent globetrotters.

Why Do Frequent Travelers Need Travel Insurance?

Frequent travelers face higher risks of trip disruptions or medical issues. Travel insurance provides financial protection, covering unexpected expenses. It ensures travelers are not burdened with unforeseen costs.

Does Travel Insurance Cover Trip Cancellations?

Yes, travel insurance often covers trip cancellations. It reimburses travelers for prepaid, non-refundable expenses. This can include flights, accommodations, and tours, providing financial relief in case of unexpected cancellations.

Can Travel Insurance Help With Medical Emergencies?

Yes, travel insurance covers medical emergencies abroad. It can include hospital stays, treatments, and medical evacuations. This ensures travelers receive necessary care without worrying about high medical costs.

Travel insurance provides peace of mind for frequent travelers. It covers unexpected events and reduces financial risks. By investing in travel insurance, you ensure a safer and more enjoyable journey.

Don’t let unforeseen circumstances ruin your trips. Protect yourself and travel with confidence every time you embark on a new adventure.