Travel insurance is vital because it provides financial protection against unexpected events and emergencies during trips. It ensures peace of mind.

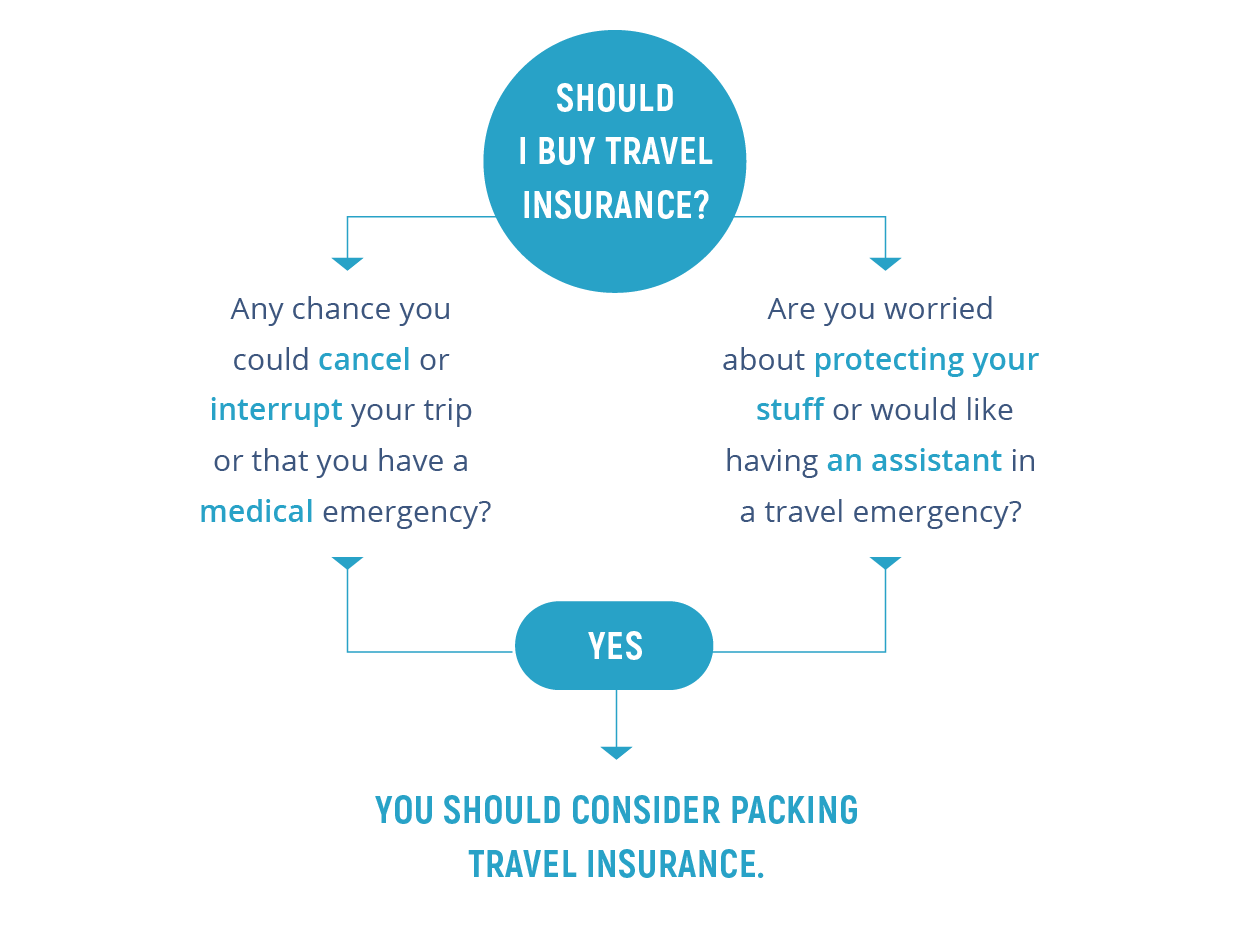

Traveling can expose you to various risks, from medical emergencies to trip cancellations. Travel insurance covers these unforeseen expenses, helping you avoid financial stress.

Medical treatments abroad can be costly, and travel insurance ensures you receive necessary care without worrying about expenses.

Lost luggage or flight delays can ruin a trip, but insurance offers compensation, making disruptions more manageable. Additionally, travel insurance often provides 24/7 assistance, offering support when you need it most.

Investing in travel insurance ensures a safer, more enjoyable travel experience, allowing you to focus on creating unforgettable memories.

What is Travel Insurance?

Traveling is an exciting adventure, but it comes with risks. Travel insurance helps protect you from unexpected events. It’s essential to understand what travel insurance is and how it works.

What Is Travel Insurance?

Travel insurance covers various unforeseen events during your trip. It can include medical emergencies, trip cancellations, lost luggage, and other mishaps. Here are some key points:

- Medical Coverage: Covers medical expenses if you fall ill or get injured.

- Trip Cancellation: Reimburses non-refundable expenses if your trip is canceled.

- Lost Luggage: Compensates for lost, stolen, or damaged baggage.

- Travel Delay: Provides benefits if your trip is delayed.

Common Misconceptions

Many people have misconceptions about travel insurance. Let’s clear up some common myths:

| Misconception | Reality |

|---|---|

| Travel insurance is too expensive. | It’s often affordable and saves money in emergencies. |

| My health insurance covers me abroad. | Most health plans do not cover international medical costs. |

| It’s unnecessary for short trips. | Even short trips can have unexpected issues. |

| All travel insurance policies are the same. | Policies vary; read terms and conditions carefully. |

Types Of Travel Insurance

Travel insurance offers peace of mind during your trips. There are different types of travel insurance to suit your needs. Understanding these types helps in choosing the right coverage.

Single Trip Vs. Multi-trip

Single trip insurance covers one specific trip. It’s ideal for occasional travelers. You get coverage for that particular journey, from start to end.

Multi-trip insurance covers multiple trips within a year. It’s perfect for frequent travelers. You save time and money by not buying insurance for each trip.

| Type | Suitable For | Benefits |

|---|---|---|

| Single Trip | Occasional travelers | Specific journey coverage |

| Multi-Trip | Frequent travelers | Year-long coverage |

Comprehensive Plans

Comprehensive travel insurance plans offer extensive coverage. They cover trip cancellations, medical emergencies, and lost luggage.

These plans are more expensive but provide peace of mind. You are protected against a wide range of potential issues.

- Trip Cancellations: Reimbursement for non-refundable costs.

- Medical Emergencies: Coverage for medical expenses abroad.

- Lost Luggage: Compensation for lost or delayed baggage.

Financial Protection

Travel insurance provides essential financial protection during your trips. It covers unexpected costs, ensuring you don’t face financial stress. Let’s delve into some key aspects of financial protection offered by travel insurance.

Medical Emergencies

Medical emergencies can happen anytime. Travel insurance covers hospital stays and doctor visits. It also includes ambulance services. Without insurance, these costs can be very high.

Consider these common medical expenses:

- Hospital stays

- Doctor consultations

- Emergency surgeries

- Medications

Having travel insurance means you get the best medical care without worry. It ensures you focus on recovery rather than costs.

Trip Cancellations

Trips can get canceled due to unforeseen events. Travel insurance covers non-refundable expenses. This includes flights, hotels, and tours.

Here’s how it helps:

| Covered Item | Potential Savings |

|---|---|

| Flight Tickets | $500 – $2000 |

| Hotel Bookings | $100 – $1000 |

| Pre-paid Tours | $50 – $500 |

Insurance ensures you don’t lose money on canceled plans. It offers peace of mind knowing your investment is protected.

Coverage For Lost Or Stolen Items

Travel insurance is essential for peace of mind during your trips. One key benefit is coverage for lost or stolen items. This feature can save you from unexpected stress and expenses.

Luggage And Personal Belongings

Your luggage may get lost or stolen. This happens often during travel. Travel insurance can help you recover the costs. It covers clothes, gadgets, and other personal items. Even if your luggage is delayed, you can get reimbursed for essentials. This can include toiletries and a change of clothes.

| Item | Covered Amount |

|---|---|

| Clothes | $500 |

| Gadgets | $1,000 |

| Toiletries | $100 |

Emergency Cash Advances

Losing your wallet abroad can be a nightmare. Travel insurance offers emergency cash advances. This can help you cover immediate expenses. You can use the cash for food, accommodation, and transport. This feature ensures you are not stranded without money.

- Food: Up to $200

- Accommodation: Up to $500

- Transport: Up to $300

This assistance is quick and efficient. It helps you get back on track fast. Always read your policy to know the exact coverage limits.

Peace Of Mind

Travel insurance provides peace of mind on your trips. It ensures that unexpected events won’t ruin your vacation. With coverage, you can relax and enjoy your journey.

Stress Reduction

Traveling can be stressful. Unexpected events like lost luggage or flight cancellations can cause worry. Having travel insurance reduces this stress.

- Lost luggage: Insurance can cover the cost of lost items.

- Flight delays: Get compensated for delays and cancellations.

- Medical emergencies: Coverage for hospital bills and medical treatments.

These benefits help you stay calm. You can focus on enjoying your trip, not worrying about problems.

Support Services

Travel insurance often includes support services. These services are available 24/7. They offer help when you need it most.

| Service | Description |

|---|---|

| Emergency Assistance | Help with medical and travel emergencies. |

| Customer Service | Support for claims and policy questions. |

| Concierge Services | Assistance with booking and reservations. |

Having access to these services enhances your travel experience. You can get help anytime, anywhere.

Legal And Medical Assistance

Travel insurance is essential for every traveler. It offers peace of mind during your journey. One key aspect of travel insurance is legal and medical assistance. This can be a lifesaver in unexpected situations.

Legal Aid Abroad

Traveling to a foreign country can be exciting. Yet, it may also be challenging. Legal issues can arise without warning. Imagine facing an accident or misunderstanding local laws. Travel insurance provides legal aid abroad. This helps you handle legal troubles effectively.

Having legal assistance ensures you get proper representation. It helps you understand the local legal system. This can be crucial if you face fines or other penalties.

Medical Evacuation

Falling sick in another country can be scary. Local hospitals might not provide the care you need. This is where medical evacuation becomes important. Travel insurance covers the cost of transporting you to a better medical facility.

Here is what medical evacuation typically includes:

- Air ambulance services

- Medical staff during transport

- Coordination with medical facilities

These services ensure you get the best possible care. They can save your life in critical situations.

| Service | Coverage |

|---|---|

| Legal Aid | Attorney fees, court costs |

| Medical Evacuation | Transport costs, medical staff |

Invest in travel insurance. Ensure your journey is safe and worry-free.

Customizable Plans

Travel insurance is crucial for every traveler. One of the best features is customizable plans. These plans can be tailored to fit your unique travel needs and preferences. Customizable plans ensure you get the right coverage without paying for unnecessary extras.

Tailored To Specific Needs

Customizable travel insurance plans are tailored to specific needs. You can choose coverage based on your travel type, such as:

- Adventure Travel: Covers extreme sports and activities.

- Business Travel: Includes coverage for work-related equipment.

- Family Travel: Ensures all family members are protected.

- Senior Travel: Focuses on medical coverage for older travelers.

Tailoring your plan means you only pay for what you need. This makes travel insurance both affordable and effective.

Add-on Options

Customizable plans offer various add-on options. These options enhance your coverage based on your specific travel requirements. Some popular add-ons include:

- Trip Cancellation: Reimburses non-refundable trip costs.

- Medical Evacuation: Covers emergency transport to medical facilities.

- Lost Luggage: Compensates for lost or delayed baggage.

- Rental Car Protection: Covers damages to rental vehicles.

Adding these options ensures comprehensive protection. It allows you to travel with peace of mind.

| Add-On Option | Benefit |

|---|---|

| Trip Cancellation | Reimburses non-refundable trip costs. |

| Medical Evacuation | Covers emergency transport to medical facilities. |

| Lost Luggage | Compensates for lost or delayed baggage. |

| Rental Car Protection | Covers damages to rental vehicles. |

Customizable plans and add-on options make travel insurance flexible. You get the coverage that suits your journey perfectly.

Choosing The Right Policy

Travel insurance is essential for a safe journey. But choosing the right policy can be tricky. It is important to compare providers and read the fine print. A good policy can save you from unexpected costs and stress.

Comparing Providers

Not all travel insurance providers are the same. Some offer better coverage, while others have lower prices. Use a table to compare features of different providers:

| Provider | Coverage | Cost | Customer Reviews |

|---|---|---|---|

| Provider A | Medical, Luggage, Cancellation | $100 | 4.5/5 |

| Provider B | Medical, Luggage | $80 | 4.0/5 |

| Provider C | Medical, Cancellation | $90 | 4.2/5 |

Compare these features before making a decision. Check for any special offers or discounts.

Reading The Fine Print

Always read the fine print. It contains important details about the policy. Look for:

- Exclusions: What is not covered?

- Limits: How much will they pay?

- Conditions: Are there any special rules?

These details can affect your claims. Make sure you understand them fully. If you have questions, ask the provider for clarification.

Frequently Asked Questions

What Is Travel Insurance?

Travel insurance is a policy offering coverage for unforeseen travel-related incidents. It includes trip cancellations, medical emergencies, and lost luggage.

Why Do I Need Travel Insurance?

Travel insurance provides financial protection against unexpected events. It ensures peace of mind and can save you from significant expenses.

Does Travel Insurance Cover Medical Emergencies?

Yes, travel insurance typically covers medical emergencies. It includes hospital stays, treatments, and sometimes medical evacuations.

Can Travel Insurance Cover Trip Cancellations?

Yes, most travel insurance policies cover trip cancellations. They reimburse non-refundable costs if you cancel for covered reasons.

Travel insurance offers peace of mind and financial protection during your trips. It covers unexpected events like medical emergencies or trip cancellations. Investing in travel insurance ensures you’re safeguarded against unforeseen expenses. Prioritize your safety and enjoy worry-free travels. Always choose a policy that suits your travel needs and destinations.