ABA and ACH routing numbers are two essential elements in the realm of banking and financial operations. Grasping the distinctions between these two types of routing numbers is vital for making well-informed choices for your enterprise. In this all-encompassing manual, we’ll unpack the complexities of ACH routing numbers, detailing their purpose, where you can locate them, and how they stand apart from ABA routing numbers. So, let’s jump in and unravel the complexities of ACH routing numbers!

What is an ACH Routing Number?

An ACH Routing Number is a nine-digit number that plays a crucial role in financial transactions in the United States. It’s like the DNA of your bank account when it comes to electronic transactions. This guide will walk you through everything you need to know about ACH Routing Numbers, from their history to their importance in modern banking.

The Birth of ACH Routing Numbers

Back in the day, the banking system was drowning in a sea of paper checks. The 1970s saw a revolutionary change with the introduction of Automated Clearing House (ACH) systems. This was the birth of ACH Routing Numbers, a nine-digit code that would become the backbone of electronic transactions in the United States. These numbers were a breath of fresh air for financial institutions, allowing them to process transactions more efficiently and securely. So, the next time you effortlessly transfer money or receive a direct deposit, remember that it all started with the inception of ACH Routing Numbers.

How ACH Routing Numbers Work

Imagine you’re sending a letter; you’d need the correct address to ensure it reaches the right destination, right? Similarly, ACH Routing Numbers act as the “address” for your electronic transactions. These numbers guide the money from the sender’s bank account to the receiver’s, all within the ACH network. They’re the unsung heroes behind your direct deposits, bill payments, and many other types of electronic transactions. The first two digits usually range from 61 to 72, setting them apart from their ABA counterparts.

The Structure of an ACH Routing Number

Numbers may seem boring, but when it comes to ACH Routing Numbers, each digit has a story to tell. The first four digits represent the Federal Reserve Routing Symbol, which identifies the Federal Reserve Bank district. The next four digits are the ABA Institution Identifier, which pinpoints the specific financial institution. Finally, the last digit is the check digit, ensuring the number is valid. Understanding this structure can save you from potential headaches, like sending money to the wrong bank.

Why ACH Routing Numbers are Important

In today’s fast-paced world, who has the time to wait for checks to clear? ACH Routing Numbers are the linchpins that hold the world of electronic transactions together. They’re crucial for various activities, from receiving your salary via direct deposit to paying your utility bills online. Without these nine-digit codes, the speed, efficiency, and security of these transactions would be compromised. In short, ACH Routing Numbers keep the financial world spinning smoothly.

The Difference Between ACH and ABA Routing Numbers

It’s easy to get tangled in the web of financial jargon. While ACH Routing Numbers are used solely for electronic transactions, ABA Routing Numbers have a broader scope. They’re used for both electronic and paper transactions, like when you’re writing a check. Knowing the difference between the two is like knowing when to use a screwdriver and when to use a hammer; it’s essential for getting the job done right.

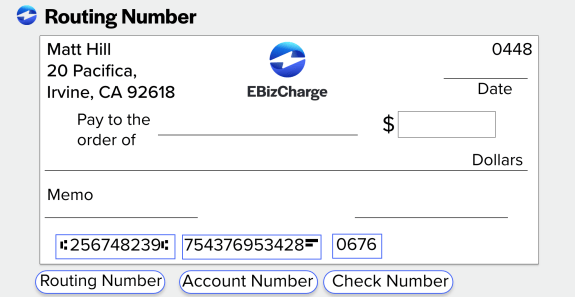

Where to Find Your ACH Routing Number

Finding your ACH Routing Number is as easy as pie. You can find it on your personal checks, right next to your account number. No checks? No problem! Most banks list this information on their websites or mobile apps. And if all else fails, a quick call to your bank will get you the information you need.

How to Use ACH Routing Numbers for Various Transactions

So you’ve found your ACH Routing Number, now what? Whether you’re setting up a direct deposit or paying bills online, using this number correctly is key. This section will walk you through the ABCs of using your ACH Routing Number for different types of transactions, ensuring you never hit a snag.

Safety Measures Associated with ACH Routing Numbers

In the age of cybercrime, safety is a top priority. Rest assured, ACH transactions are secure. They’re processed through encrypted networks and require authentication steps. So, while you should be cautious when sharing any financial information, know that ACH Routing Numbers come with built-in safety measures.

Common Mistakes People Make with ACH Routing Numbers

We’re all human, and mistakes happen. Maybe you’ve entered the wrong number or confused an ACH Routing Number with an ABA Routing Number. This section will cover the common pitfalls and how to avoid them, saving you time and potential frustration.

FAQs

- What is an ACH Routing Number used for?

It’s used for electronic transactions like direct deposits and bill payments. - How do I find my ACH Routing Number?

Check your personal checks, and bank statements, or contact your bank. - Can I use an ABA Routing Number instead of an ACH Routing Number?

It depends on the type of transaction. ABA is for both paper and electronic, while ACH is only for electronic. - Is it safe to share my ACH Routing Number?

Generally, yes, but only share it with trusted entities. - What happens if I use the wrong ACH Routing Number?

The transaction will likely be rejected or delayed. - How do ACH Routing Numbers differ from Swift Codes?

ACH is used for domestic transactions, while Swift Codes are for international.

Understanding “What is an ACH Routing Number?” is not just for financial whizzes; it’s essential knowledge for anyone who deals with electronic transactions. These nine-digit codes are the unsung heroes of the financial world, ensuring that your money gets where it needs to go, safely and efficiently.