What Does a Virtual CFO Do? Let’s dive into this fascinating world of finance!

Welcome to the realm of Virtual CFOs! You may be wondering, “What does a Virtual CFO do?” Well, imagine having a financial expert on your team who doesn’t physically work in your office but guides you through crucial financial decisions.

Picture this: a Virtual CFO is like having a finance wizard at your fingertips! They help businesses manage their money, make smart investments, and create strategic financial plans for growth.

With a Virtual CFO, you can say goodbye to the stress of financial matters, and hello to expert guidance that can take your business to new heights. Let’s explore the fascinating world of virtual financial management!

A Virtual CFO plays a crucial role in business financial management. They help with budgeting, forecasting, financial analysis, and strategic planning. They also provide insights and recommendations to improve profitability and cash flow.

Furthermore, Virtual CFOs can assist with financial reporting, risk management, and compliance with regulatory requirements. Their expertise and guidance can be invaluable for businesses seeking financial stability and growth.

What Does a Virtual CFO Do?

A virtual Chief Financial Officer, or virtual CFO, is an outsourced financial professional who provides strategic financial guidance and support to businesses remotely. While traditional CFOs are typically full-time, in-house employees, virtual CFOs offer their expertise on a part-time or project basis. They work closely with business owners and management teams to manage complex financial matters, analyze data, create financial forecasts, and develop strategies to optimize business performance.

The Role of a Virtual CFO

A virtual CFO plays a vital role in helping businesses make informed financial decisions and achieve their financial goals. Here are three key areas where a virtual CFO contributes:

Financial Planning and Analysis

A virtual CFO helps businesses develop and implement financial strategies aligned with their goals. They analyze financial data, identify trends and opportunities, and provide insights that guide the company’s financial decisions. By creating budgets, forecasting revenue and expenses, and monitoring cash flow, virtual CFOs help businesses stay on track and make proactive adjustments as needed.

Furthermore, a virtual CFO conducts financial risk assessments to identify potential risks that may impact the business and develops risk management strategies. They also keep businesses informed about industry-specific financial trends and best practices, ensuring that the company remains competitive and financially stable.

Financial Reporting and Compliance

Virtual CFOs handle all aspects of financial reporting and compliance to ensure accuracy, transparency, and regulatory compliance. They prepare financial statements, including income statements, balance sheets, and cash flow statements. These statements provide a comprehensive overview of the company’s financial health and performance.

In addition, virtual CFOs take care of tax planning and preparation, ensuring that businesses are in compliance with tax laws and regulations. By monitoring changes in tax laws, they help businesses take advantage of available tax incentives and minimize tax liabilities.

Virtual CFOs also work closely with auditors and financial institutions during audits and provide the necessary documentation and information to ensure a smooth process.

Strategic Financial Advisory

One of the primary roles of a virtual CFO is to offer strategic financial advice and guidance. They assess the company’s financial position, identify areas for improvement, and recommend financial strategies to achieve the business’s goals. Whether it’s optimizing cash flow, improving profitability, or making investments, virtual CFOs provide actionable insights to drive financial growth and success.

Moreover, virtual CFOs assist with financial negotiations and transactions, such as mergers and acquisitions, investments, and fundraising. They analyze the financial aspects of these deals, perform due diligence, and provide guidance to ensure favorable outcomes for the business.

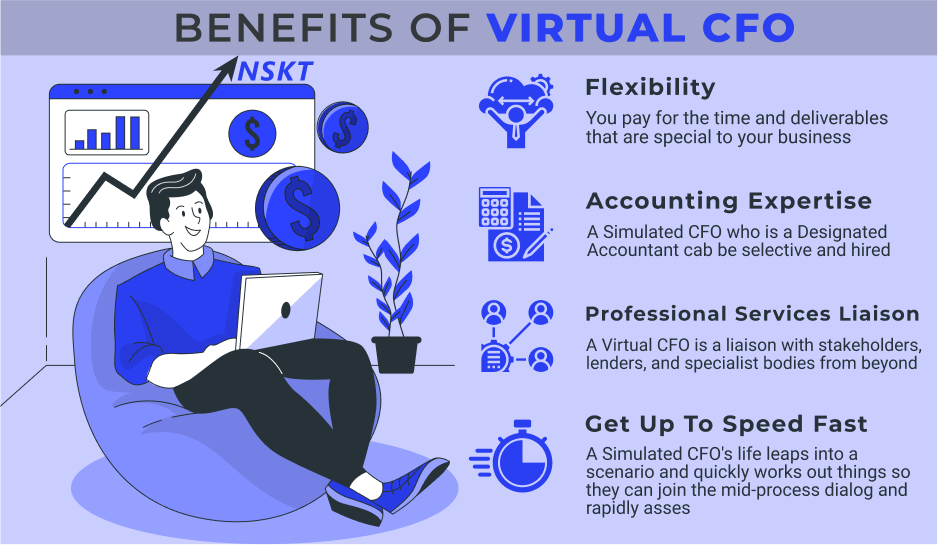

How a Virtual CFO Benefits Businesses

Having a virtual CFO brings numerous benefits to businesses of all sizes. Here are some of the advantages:

Cost Efficiency

Hiring a full-time CFO can be expensive, especially for small and medium-sized businesses. By opting for a virtual CFO, businesses can access expert financial guidance at a fraction of the cost. Virtual CFOs work on a flexible, part-time basis, allowing businesses to utilize their services as needed, eliminating the overhead costs associated with full-time employees.

Expertise and Experience

Virtual CFOs are highly qualified professionals with extensive experience in finance and accounting. They bring a wealth of knowledge and expertise to the table, providing businesses with insights that drive financial growth and success. Their experience across various industries enables them to tailor financial strategies to the specific needs and challenges of each business.

Focused Financial Management

With a virtual CFO, business owners and management teams can focus on their core competencies and strategic initiatives, knowing that their financial matters are in capable hands. Virtual CFOs handle the day-to-day financial management, allowing businesses to allocate resources effectively and prioritize their business goals.

Scalability

As businesses grow and evolve, their financial needs change. Virtual CFOs offer scalability, adapting their services to meet the evolving requirements of the business. Whether it’s expanding into new markets, raising capital, or navigating financial challenges, virtual CFOs provide the flexibility needed to support business growth.

Risk Mitigation

Virtual CFOs play a crucial role in mitigating financial risks for businesses. Their expertise in risk assessment and management helps identify potential threats and develop strategies to minimize or overcome them. By staying informed about industry-specific financial trends and competitors, virtual CFOs ensure that businesses can adapt and thrive in a highly dynamic business landscape.

Increased Financial Transparency

Virtual CFOs bring transparency to financial processes and reporting, providing accurate and timely financial information. This transparency enables businesses to make informed decisions, improve accountability, and gain the trust and confidence of stakeholders such as investors, lenders, and partners.

Access to Cutting-Edge Technology

Virtual CFOs utilize advanced financial software and tools, giving businesses access to the latest technology without the need for significant investments. These tools streamline financial processes, enhance data accuracy, and provide real-time insights, allowing businesses to make informed financial decisions promptly.

Things to Consider When Hiring a Virtual CFO

Expertise and Industry Knowledge

When selecting a virtual CFO for your business, it’s crucial to consider their expertise and industry knowledge. Look for professionals who have experience in your specific industry and a track record of delivering results.

Communication and Availability

Effective communication with your virtual CFO is key to a successful relationship. Ensure that they are responsive, available when needed, and can effectively communicate complex financial concepts in a way that is easily understandable.

References and Client Feedback

Before hiring a virtual CFO, ask for references or client feedback to get a sense of their reputation and the quality of their services. This will help you assess their reliability and professionalism.

Compatibility and Alignment

It’s essential to find a virtual CFO who understands your business goals, values, and culture. Building a strong partnership requires alignment in vision and objectives.

Budget and Cost

Determine your budget and evaluate the cost of hiring a virtual CFO. Compare the fees with the value they provide to ensure it aligns with your financial goals.

Data Security and Confidentiality

Virtual CFOs have access to sensitive financial data, so it’s crucial to ensure they prioritize data security and confidentiality. Inquire about the measures they have in place to protect your business’s financial information.

Proven Track Record

Consider virtual CFOs who have a proven track record of successfully assisting businesses in achieving their financial objectives. Look for certifications, previous client success stories, or testimonials that demonstrate their expertise and capabilities.

The Future of Virtual CFOs

The demand for virtual CFOs is expected to continue growing as businesses recognize the benefits of outsourcing financial expertise. Virtual CFOs provide cost-efficient solutions that deliver high-quality financial guidance to businesses of all sizes. With advances in technology, virtual CFOs can collaborate seamlessly with businesses worldwide, breaking down geographical barriers and expanding their reach.

A virtual CFO offers businesses the opportunity to tap into expert financial guidance without the cost and commitment of employing a full-time CFO. From financial planning and strategic advice to compliance and risk management, virtual CFOs play a vital role in ensuring the financial health and success of businesses. By selecting the right virtual CFO, businesses can gain a competitive edge, make informed financial decisions, and achieve their long-term goals.

Frequently Asked Questions

Welcome to our Frequently Asked Questions section about virtual CFOs. Below, we have provided answers to some common queries regarding the role and responsibilities of virtual CFOs. Read on to learn more!

What is the role of a virtual CFO?

A virtual CFO, or Chief Financial Officer, is responsible for managing the financial aspects of a business remotely. They provide strategic financial guidance and help business owners make informed decisions to drive growth and profitability. Virtual CFOs offer services such as financial planning and analysis, budgeting, cash flow management, and financial reporting. They work closely with business owners to understand their goals and develop strategies to achieve them. Additionally, virtual CFOs often oversee tax planning, risk management, and financial compliance.

By leveraging technology and working remotely, virtual CFOs offer cost-effective financial expertise to businesses of all sizes. They help streamline financial operations, optimize resources, and provide valuable insights to drive financial success.

Why should I consider hiring a virtual CFO?

There are several reasons why hiring a virtual CFO can be beneficial for your business. Firstly, a virtual CFO offers flexible and scalable services. Whether you are a startup or a growing enterprise, you can access financial expertise on-demand without the need for a full-time, in-house CFO. This allows you to save costs while still receiving high-quality financial guidance.

Secondly, virtual CFOs bring an objective perspective to your business. They can assess your financial health, identify areas for improvement, and provide strategic recommendations based on their extensive experience. They can help you analyze financial data, make data-driven decisions, and align your financial goals with your broader business objectives.

What industries can benefit from hiring a virtual CFO?

Virtual CFOs can benefit businesses across a wide range of industries. Whether you are in technology, healthcare, retail, or professional services, a virtual CFO can provide valuable financial insights and strategic guidance. They have experience working with diverse businesses and can tailor their services to meet your industry-specific needs.

Virtual CFOs can help startups establish strong financial foundations, assist growing businesses with financial planning and scaling, and support established enterprises with financial analysis and optimization. Regardless of your industry, a virtual CFO can play a crucial role in driving your financial success.

How do virtual CFOs ensure data security?

Data security is a top priority for virtual CFOs. They use secure and encrypted communication channels to exchange financial information with their clients. They also adhere to strict confidentiality policies to protect sensitive data. Virtual CFOs are experienced in working with cloud-based accounting systems and employ industry-standard security measures to safeguard financial data.

Before hiring a virtual CFO, it is important to discuss their data security protocols and ensure that their practices align with your business’s security requirements. Additionally, signing non-disclosure agreements (NDAs) can provide an added layer of protection for your confidential information.

Can virtual CFOs work with businesses remotely?

Absolutely! Virtual CFOs specialize in working remotely and can effectively collaborate with businesses from anywhere in the world. With the advancement of technology and cloud-based accounting platforms, virtual CFOs can access financial data, conduct analysis, and provide real-time financial insights without the need for physical presence.

Virtual CFOs use video conferencing, email, and other online collaboration tools to communicate with their clients. This remote working model allows businesses to access expert financial guidance without the constraints of geographic location, making it a convenient and efficient solution for businesses of all sizes.

A virtual CFO is like a financial superhero who helps businesses manage their money. They provide expert advice on budgeting, forecasting, and financial strategy. Think of them as a financial consultant who works remotely to help a company make smart financial decisions.

Virtual CFOs can also handle tasks like bookkeeping and financial reporting, freeing up time for business owners to focus on growing their company. They are flexible and cost-effective, providing high-quality financial expertise without the need for a full-time in-house CFO. So, if you want someone to help you with your business finances, consider hiring a virtual CFO to save the day!